Is Cryptocurrency a Scam?

Cryptocurrency itself is not a scam. But Is Cryptocurrency a Scam it’s a big question. but It is a technology that enables decentralized digital transactions. However, scams can occur within the cryptocurrency space, such as fraudulent projects or investment schemes. It’s essential to exercise caution, do thorough research, and be aware of potential risks when dealing with cryptocurrencies.

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrencies are often lauded for their potential to provide a more secure and efficient way of conducting transactions compared to traditional fiat currencies. However, cryptocurrencies have also been associated with scams and illicit activity due to their anonymous nature. It is important to do your research before investing in any cryptocurrency.

How Cryptocurrency Works

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are built on blockchain technology, a decentralized ledger that records all transactions. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin nodes validate transactions by solving a proof-of-work problem that allows them to chain together blocks of transactions (hence the name “blockchain”). Bitcoin miners are rewarded with bitcoin for verifying and committing transactions to the blockchain.

Cryptocurrency exchanges are online platforms where you can buy, sell, or trade cryptocurrencies for other digital assets or traditional currencies like US dollars. Some popular cryptocurrency exchanges include Coinbase, Binance, and Kraken.

Advantages and Disadvantages of Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

While there are many advantages to cryptocurrency, there are also some disadvantages. One of the biggest disadvantages is that cryptocurrencies are extremely volatile. Their prices can fluctuate greatly in a short period of time. This makes them risky investments and difficult to use as a currency. Additionally, because cryptocurrencies are not regulated by governments or financial institutions, they are susceptible to fraud and theft.

Common Misconceptions about Cryptocurrencies

Cryptocurrencies are often associated with illegal activities, such as money laundering and drug trafficking. However, there are many legitimate uses for cryptocurrencies. For example, cryptocurrencies can be used to send money internationally without incurring high fees.

Cryptocurrencies are also often thought of as being risky investments. While it is true that the value of cryptocurrencies can fluctuate greatly, they can also offer the potential for high returns. Therefore, investors should do their own research before investing in cryptocurrencies.

Some people believe that cryptocurrencies are not backed by anything and thus are not worth anything. However, many cryptocurrencies are backed by assets, such as gold or real estate. Additionally, the blockchain technology that powers most cryptocurrencies is becoming increasingly valuable itself.

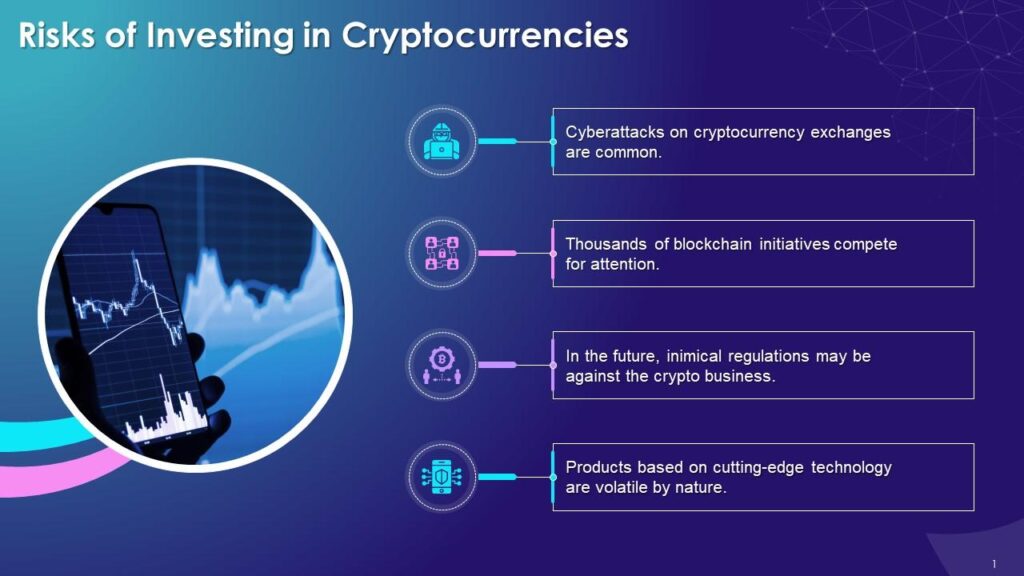

The Dangers of Investing in Cryptocurrencies

Cryptocurrencies, also known as virtual or digital currencies, are not backed by any government or central bank, and therefore are extremely volatile and risky investments. For example, in December 2017, the value of Bitcoin, the most well-known cryptocurrency, skyrocketed to nearly $20,000 per coin before crashing back down to around $3,000 just a few months later. Many other cryptocurrencies have experienced similar (and even more extreme) fluctuations in value.

Additionally, cryptocurrencies are often used by criminals for illegal activities such as money laundering and drug trafficking due to their anonymous nature. In fact, a recent study found that nearly 25% of all Bitcoin transactions are associated with illegal activity.

So, if you’re thinking about investing in cryptocurrencies, be aware of the risks involved. You could potentially lose all of your investment, and even worse, end up unwittingly supporting criminal activity.

Alternatives to Investing in Cryptocurrency

There are many alternative investments to cryptocurrency. Some examples include:

- Traditional stocks and bonds

- Mutual funds

- Index funds

- Exchange traded funds (ETFs)

- Real estate investment trusts (REITs)

- Commodities such as gold and silver

Each of these alternative investments has its own set of risks and rewards. For example, stocks and bonds tend to be less volatile than cryptocurrency, but they also offer lower returns. Mutual funds and ETFs offer diversification away from cryptocurrency, but they come with management fees that can eat into returns. And finally, commodities like gold and silver have been used as a store of value for centuries, but they can be volatile and difficult to trade.

The best way to choose an alternative investment is to first assess your goals, risk tolerance, and time horizon. From there, you can research the different options and decide which one is best for you.

Conclusion

The answer to the question of whether cryptocurrency is a scam depends on your understanding and perspective. While there are certain risks associated with investing in cryptocurrencies, like any other investment, it can be an option worth considering if you research thoroughly and understand the potential risks as well as rewards involved.

It’s important to remember that cryptocurrencies offer huge opportunities for making money, but they also come with significant volatility and risk. As always, do your own due diligence before investing in any asset class or currency.